Why non-KYC?

With the recent news that the worlds biggest Bitcoin on ramp intends to start selling blockchain analysis software to the U.S government, it felt only right I try to steer people away from their shady practices. Think about that for a second, the same people that sell you your bitcoin also want to sell tools to the U.S government so that they can track you on chain.

To buy bitcoin from Coinbase or any other KYC exchange, users will need to provide personal information. Usually this info is in the form of name, address, drivers license, and in some cases a selfie holding a piece of paper with the name of the exchange and the date.

KYC information not only ties your personal identity to any bitcoin you purchase, but also creates a huge honey pot of sensitive information at risk of being stolen due to incompetent security practices at some of these companies. Once you purchase bitcoin via KYC, no amount of coinjoining or elaborate spending techniques will erase the fact that on X date and at X time, this person bought X amount of bitcoin from this exchange.

If this doesn’t sound like much a problem to you and you don’t see it as a threat then that’s cool. KYC exchanges generally offer a slicker user experience which is attractive to Bitcoin newcomers, just be aware of the tradeoffs. Once you give up that data, they have it forever.

However, if the above is a concern for you, there are plenty of alternatives.

Enter Bisq…

What is Bisq?

Bisq is a decentralised bitcoin exchange that users access via desktop app that runs over the Tor network. It requires no KYC information and enables users to buy or sell directly with one another without a trusted third party. Bisq secures trade funds using a 2 of 2 multi-sig escrow system and encrypts all communications between the two parties.

Your first trade using Bisq

I’m a firm believer that a lot of people shy away from decentralised exchanges because generally there are some extra steps a. There are no central Bisq Servers, it is completely peer to peer and non custodial. You are always in control of your own funds.

Hopefully this brief walkthrough of a Bisq trade will show you that it’s not as scary as you might have first thought! I have blanked out any sensitive information to preserve my privacy. This whole trade took me 10 minutes which includes taking screenshots along the way for this article. Depending on your chosen payment method your trade time may vary.

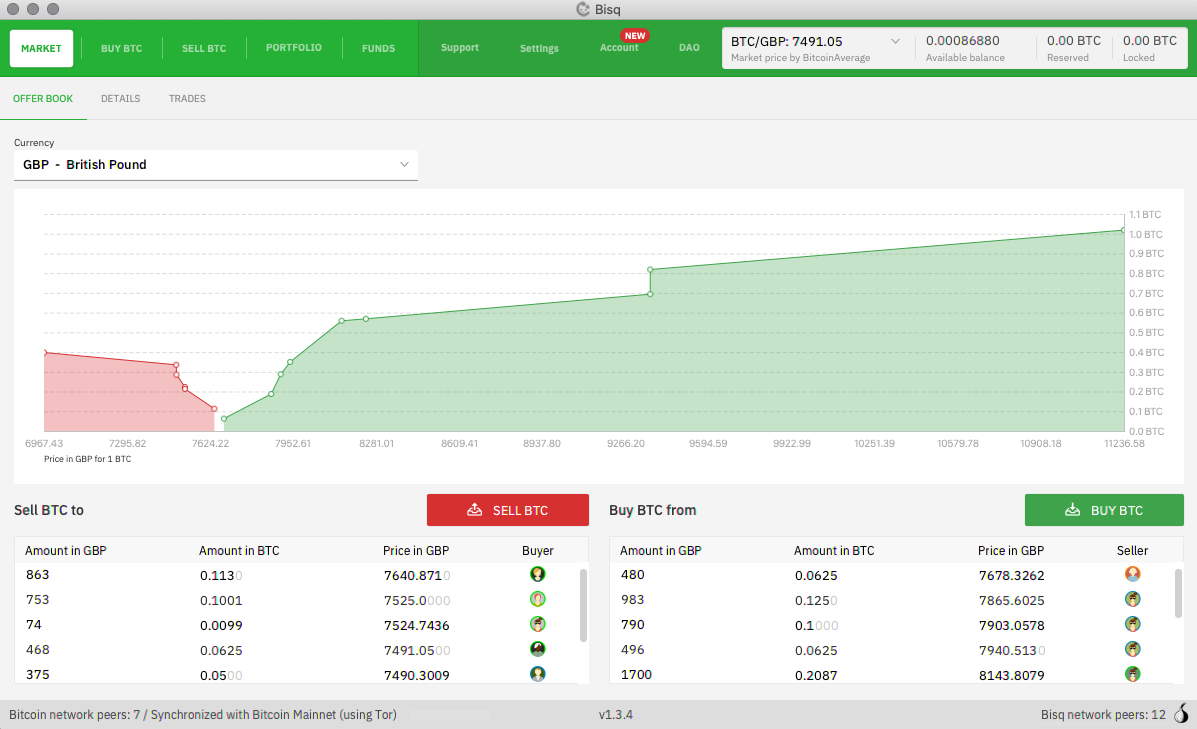

1. Download the software for your OS, verify it’s legitimate using the Verfication section in the release notes area and install it. If you’d like a great step by step guide on how to do this very impoortant verification process, check out Athena Alpha’s guide for Ubuntu here and for Windows here. Afterwards you’ll be met with the home screen

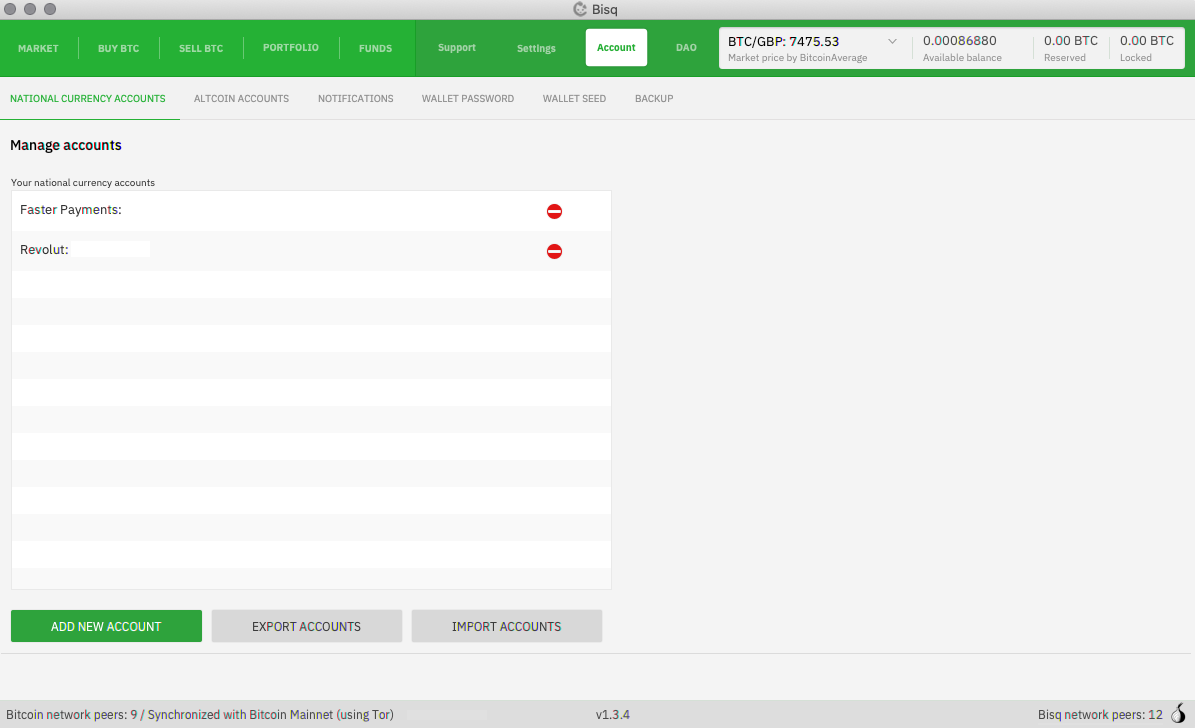

2. Click on account and add the payment method you intend to use to purchase bitcoin with. There are nearly 30 different methods on offer including Faster Payments, Revolut and SEPA.

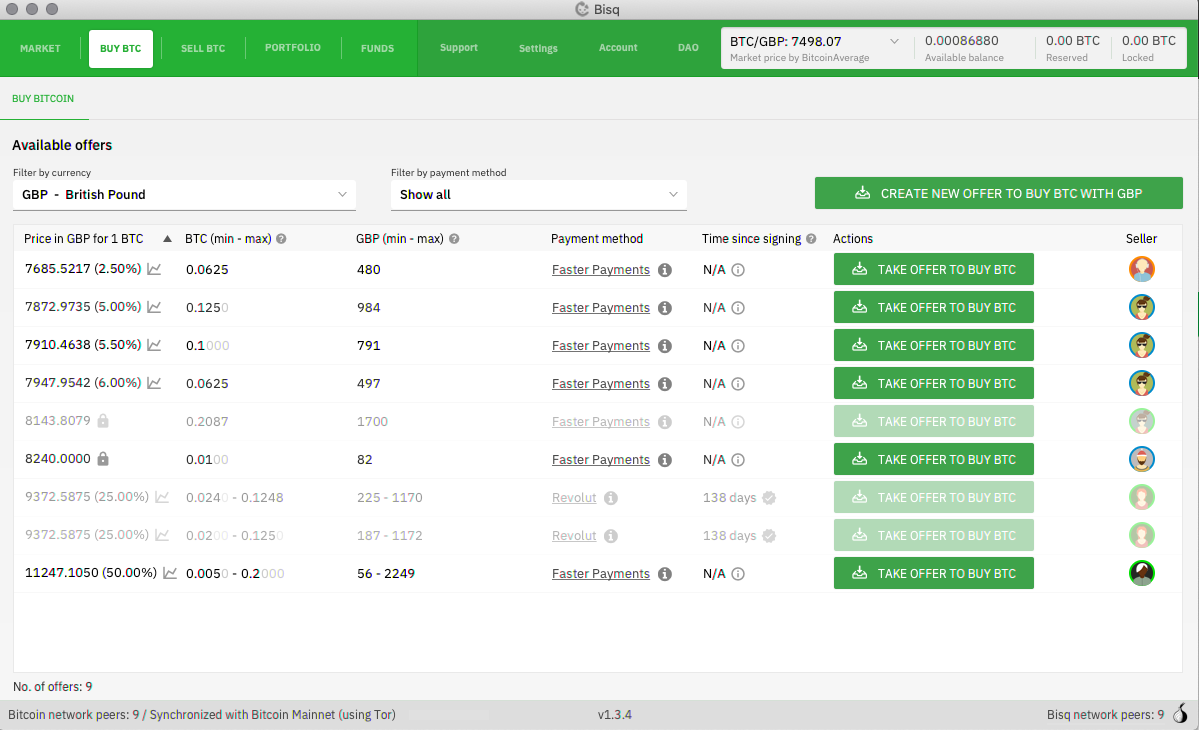

3. Now that your payment method is setup you can go to the ‘Buy BTC’ tab and see the sellers offering bitcoin in exchange for your chosen payment method. Here you can see the BTC price, percentage difference compared to the ‘spot’ price and the quantity of bitcoin for sale from each seller. Once you have found an offer you like, click ‘Take offer to buy BTC’.

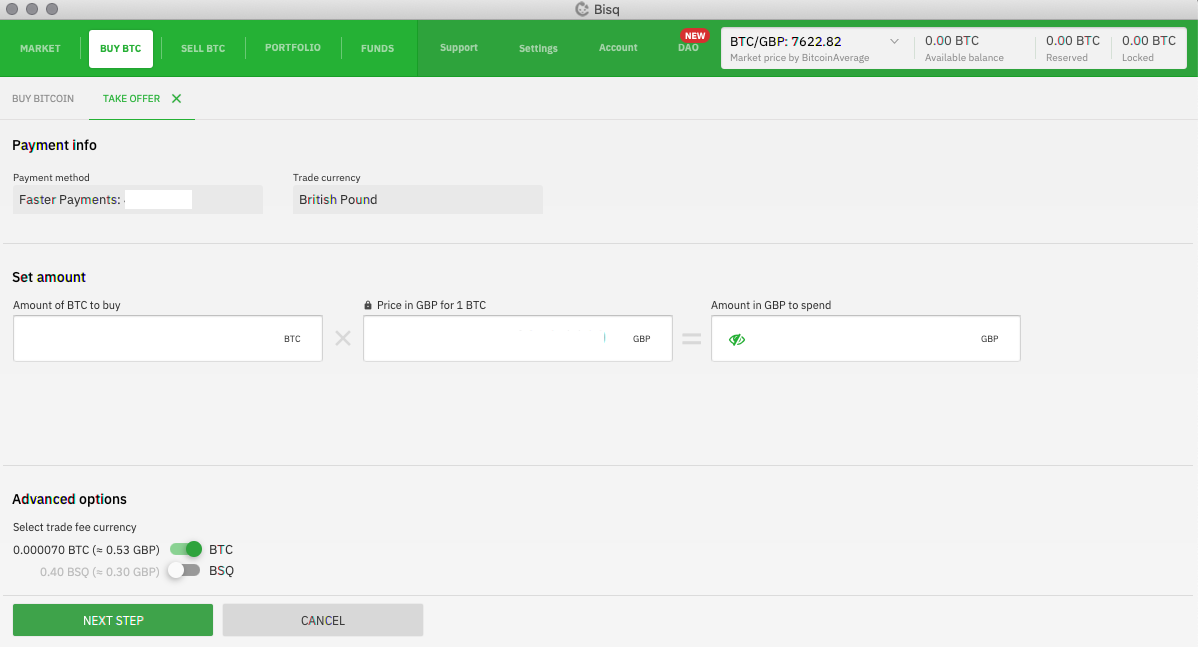

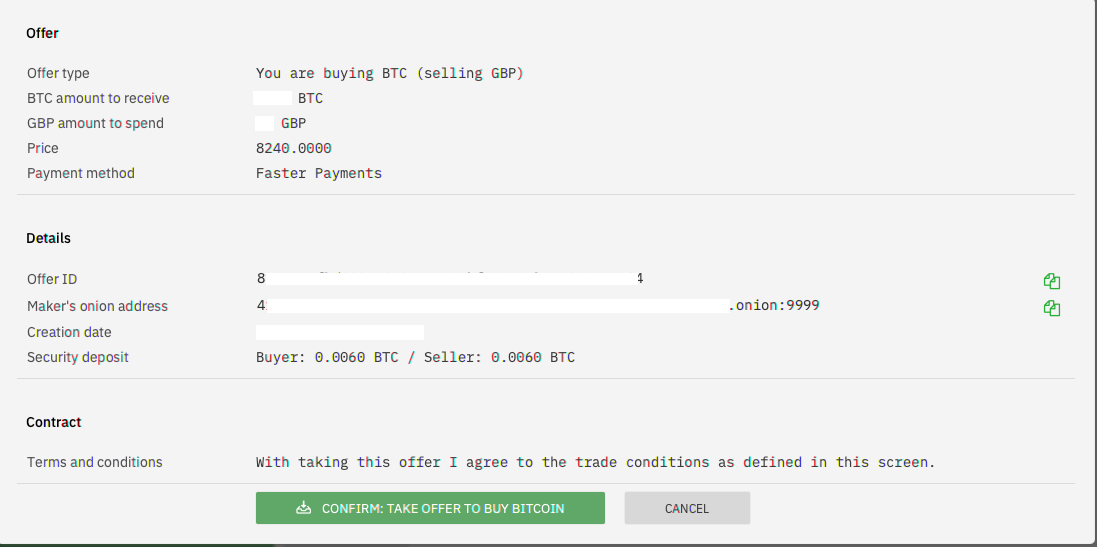

4. This will take you through to a screen this screen for you to check and confirm details before entering the trade. When you are happy, hit ‘next step’.

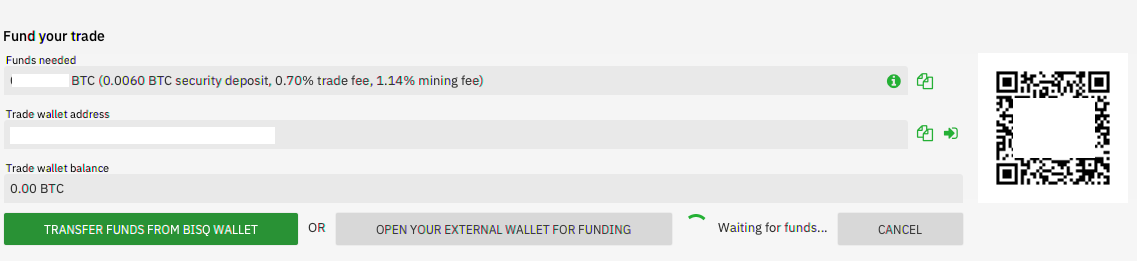

5. You now need to fund your trade wallet with a small amount of bitcoin which acts as a security deposit. This is usually around 15% of the trade size. The seller also has to post a deposit on their side.

6. You can now confirm the offer and start the trade

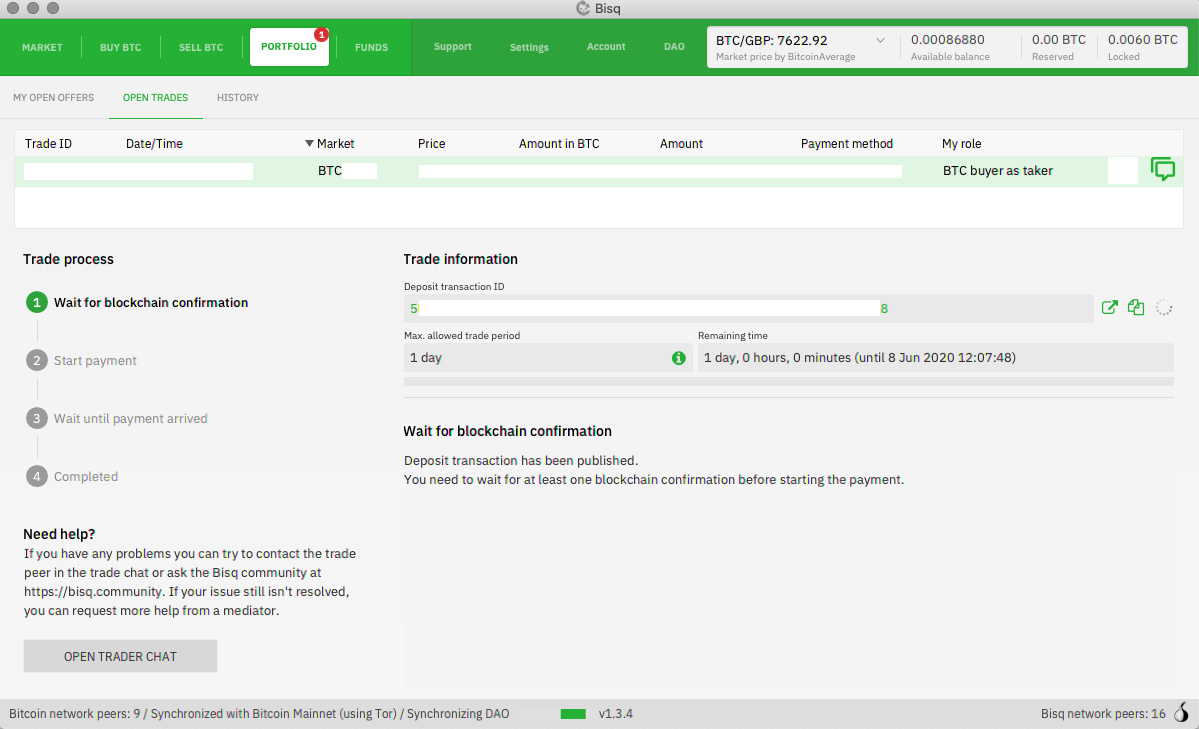

7. You will now have a very short wait while the Bitcoin network confirms the trade’s transaction which puts both parties security deposits into the escrow multi-sig.

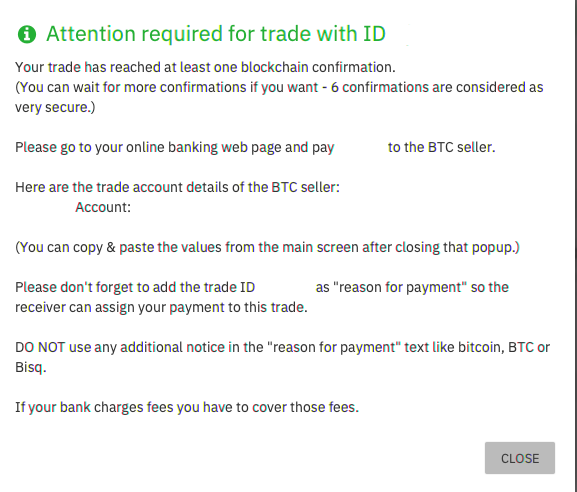

8. After one confirmation on chain you will then see a window with the sellers details for you to send payment to.

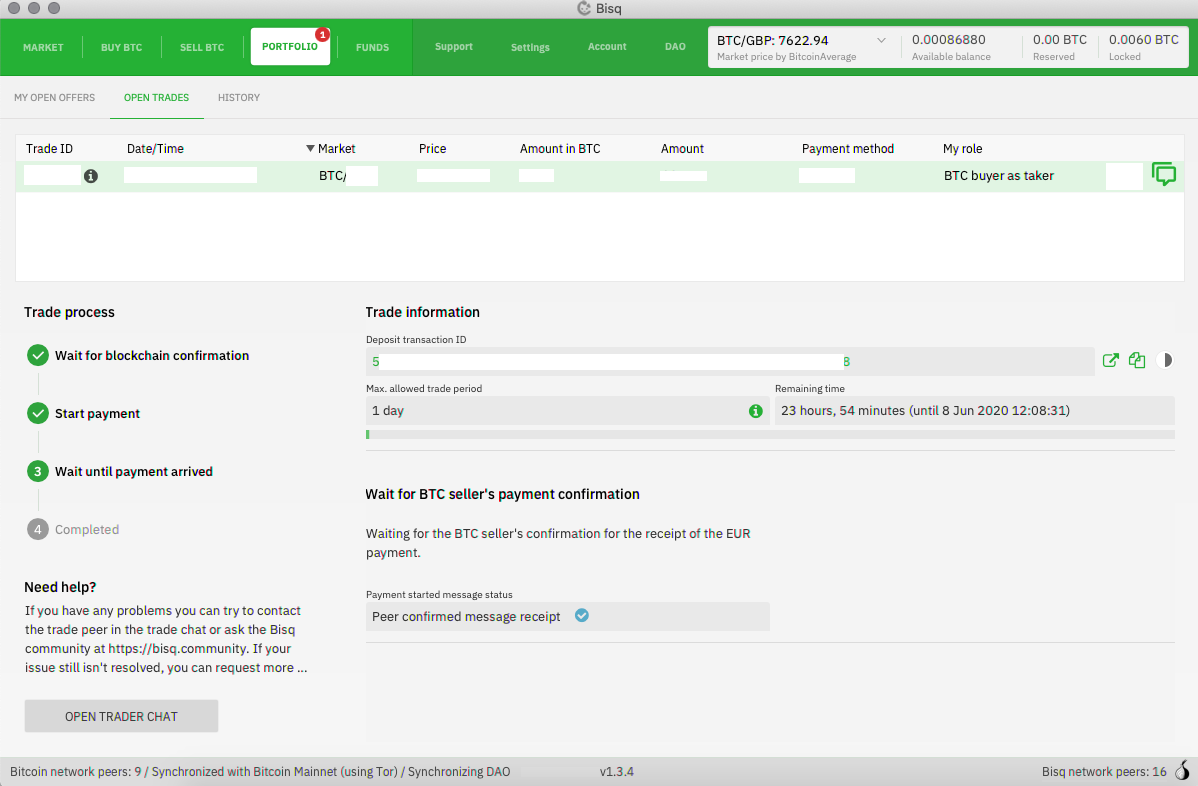

9. Once you have sent the payment, press the button to confirm you have done so and then wait for the seller to confirm they have received your funds. At this point you can also chat with your trading partner via end to end encrypted messaging buy pressing ‘Open trader chat’.

Once the seller confirms receipt of funds, the purchased bitcoin along with your security deposit will be released into your Bisq wallet.

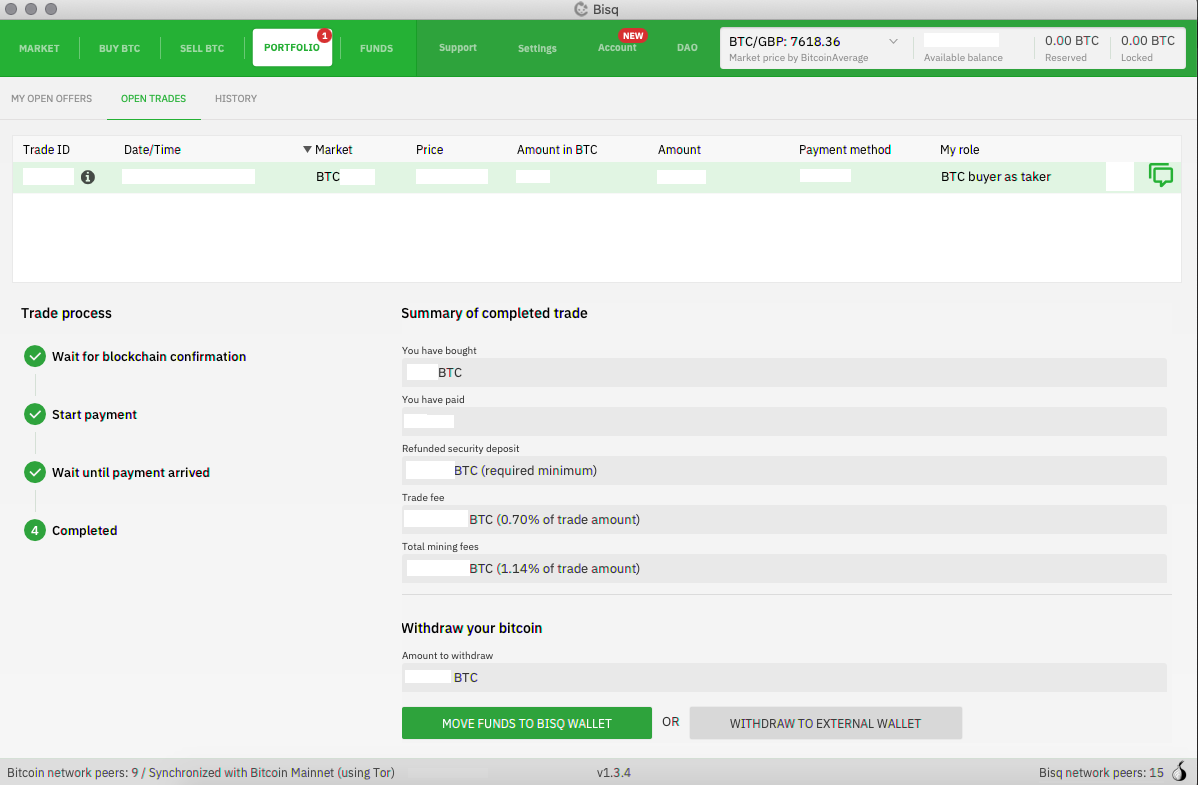

10. Thats it, your first trade is now complete! You can now either withdraw your bitcoin to an external wallet or leave in your Bisq account.

The tradeoffs with buying non-KYC

As simple as buying on Bisq is, there are some tradeoffs to be aware of.

1. You need BTC before you trade to form a security deposit. Not a problem if you have been around for a while but could become an issue if you want to use Bisq as your first buy. Your best option in this instance is to get some bitcoin from a friend or family member.

2. KYC free bitcoin often attracts a premium above the spot price which can put some buyers off. As I discussed earlier, this is about tradeoffs and I would personally would be happy to pay 5-8% above spot price for the luxury of keeping my personal data safe.

If you are not in a rush to purchase then you can also set up a ‘Buy Offer’ where you can let the Bisq network know that you are willing to purchase an amount of bitcoin at a certain price relative to the market value. If a seller comes along and likes your offer they can take you up on it.

3. Decentralised exchanges can sometimes suffer from liquidity shortages when compared with larger centralised entities. If you are looking to buy larger amounts more frequently, you may struggle.

4. Although it has never happened to me, sometimes peer to peer trading doesn’t work out as intended and users will need to go through the dispute resolution process. Fortunately due to the way Bisq’s incentive structures are built, these instances are few and far between.

As with most things Bitcoin related, the whole KYC/Non-KYC debate is nuanced and full of tradeoffs. I get it, the most common fiat onramps like Coinbase and CashApp make life very easy to buy, particularly for newbies, but please take a second to consider the tradeoffs and look into the alternatives before giving away your personal information so readily.

KYC is forever.

The next time you decide you want to stack some sats I urge you to give Bisq a try!

To read more about Bisq visit their documentation page and have a read of this article by @ElkimXOC which provides a VERY in depth look at Bisq including instructional videos. Athena Alpha also has a step-by-step guide on how to buy bitcoin on Bisq here as well as a full review here.

Disclaimer - All views expressed in this article are my own and not those of the Bisq team. I am not affiliated with Bisq in any way.