So you’ve read my original article about buying non-KYC bitcoin via Bisq and hopefully given it a go, well done! If you haven’t done so already, go and read that article first as it covers some of the basics around why buying non-KYC is important.

This article is to explore one of the other options on the market, Hodl Hodl.

What is Hodl Hodl?

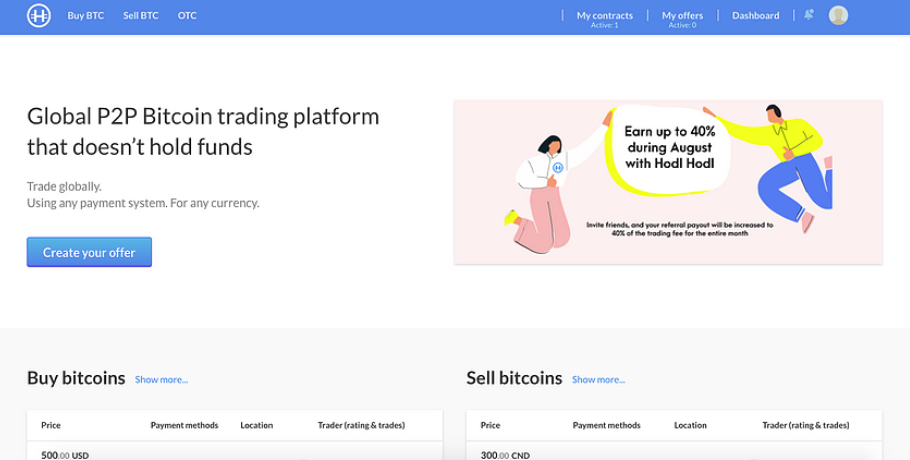

Like Bisq, HodlHodl is a decentralised bitcoin exchange. However, Hodl Hodl is accessed via a web browser rather than a dedicated app. At the application layer, it requires no KYC information although certain sellers do require this. I would advise you to go with a seller that doesn’t ask for your selfie, after all, that’s why we’re here!

How does Hodl Hodl work?

Hodl Hodl is a peer to peer platform that allows users to buy and sell bitcoin without any middle men. At a high level, when you want to buy bitcoin via Hodl Hodl, you enter a contract with the seller. Hodl Hodl creates a 2 of 3 multisig escrow address, two keys held by the buyer and seller, and Hodl Hodl holding the third key in the unlikely event that a dispute occurs.

As well as taking other peoples offers, you can create your own buy offer at a specified price and/or amount and wait for a seller to reach out to you, though this can sometimes take a little longer.

Your first trade using Hodl Hodl

1. Visit hodlhodl.com and create your account. The only details you need to provide is a username and email address. You will then be met with the home page.

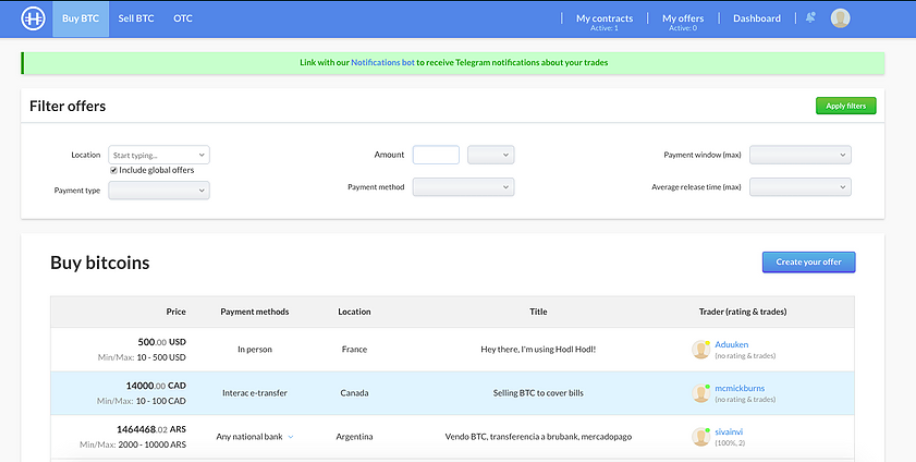

2. Click ‘Buy BTC’ in the website header.

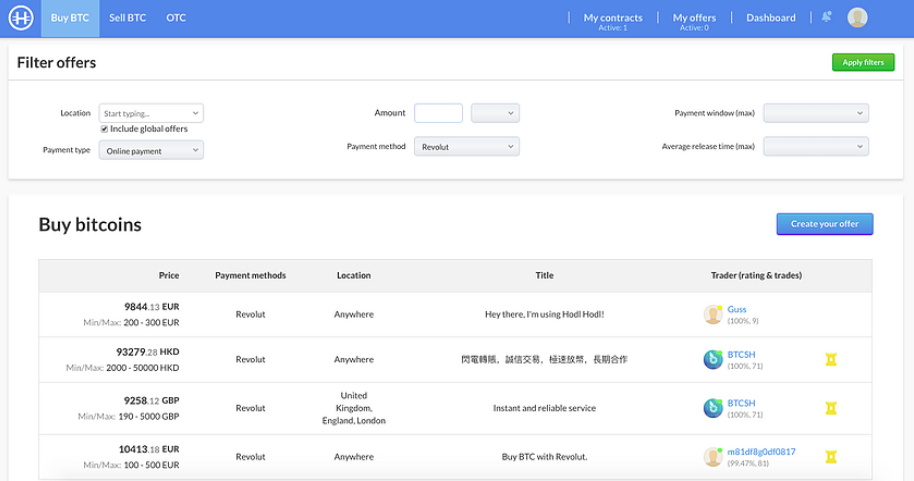

3. Select your desired payment type and method. You can also specify a specific amount here if necessary.

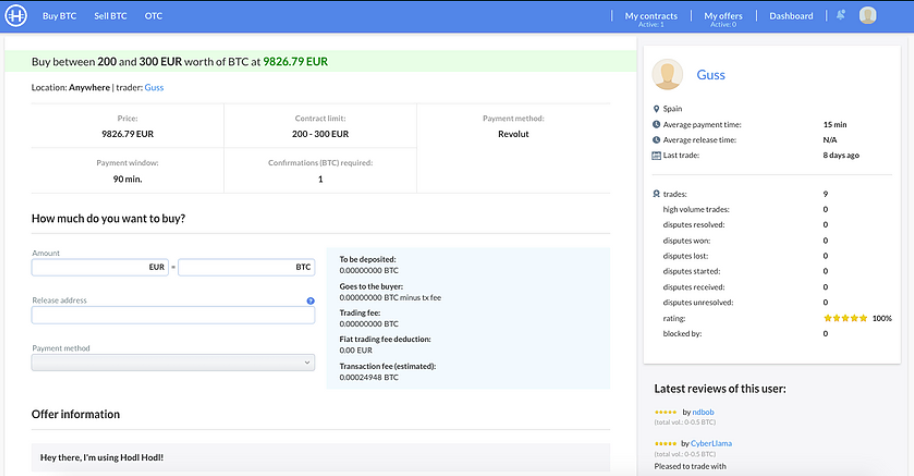

4. Select your desired offer. You can then review the trade details and also read the peer’s activity reports and ratings.

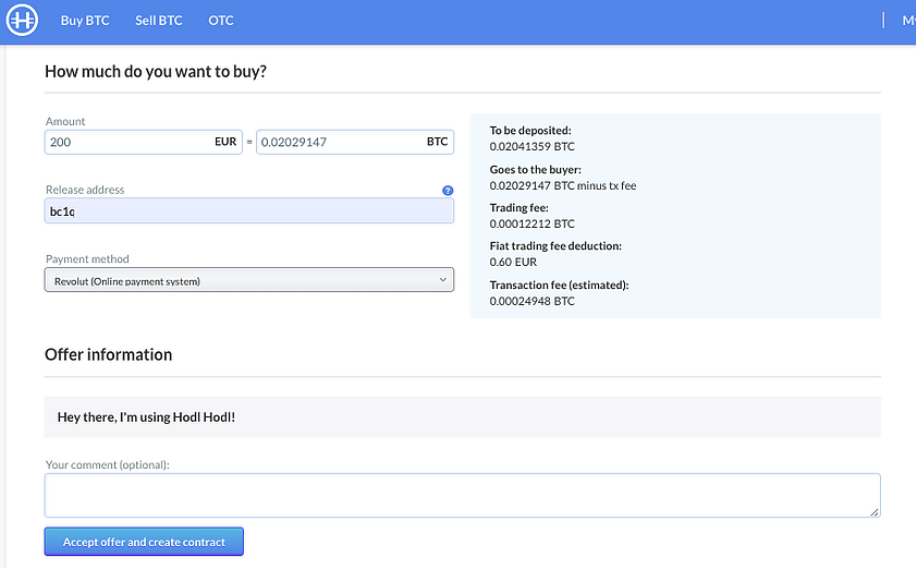

5. Once you are happy, you can specify how much you want to buy, enter in the address you would like the bitcoin sent to and specify confirm the payment method advertised by the seller. Click ‘Accept offer and create contract’.

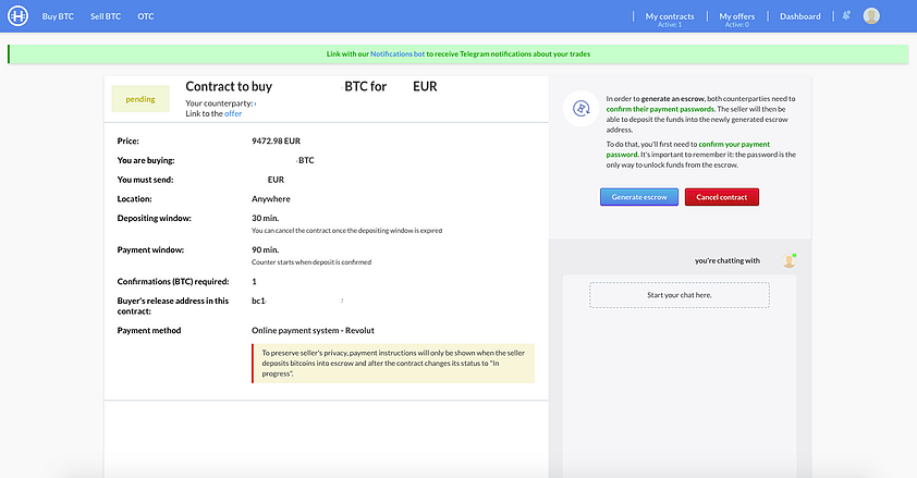

6. You now have your contract created and need to hit ‘Generate Escrow’ where you will be prompted to create a payment password. The payment password is an encryption key for the user’s escrow key pair. It is used in order to deposit or release Bitcoin to or from escrow.

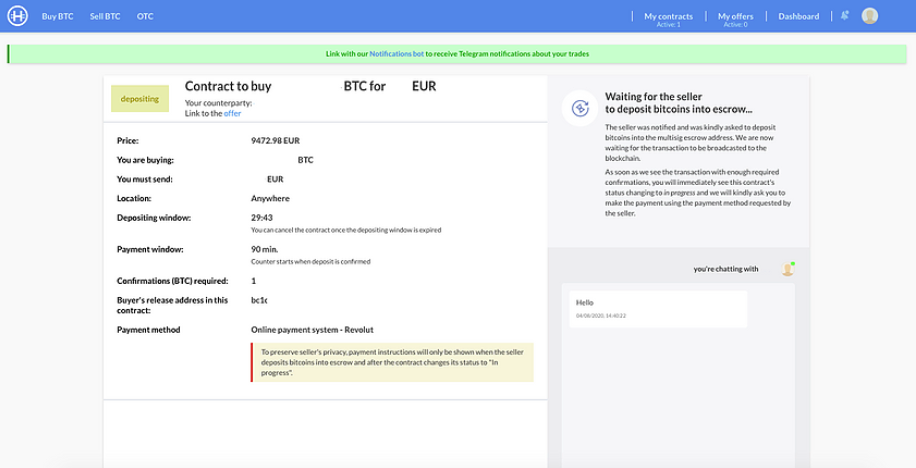

7. Now you need to wait for the seller to deposit their bitcoin into the escrow wallet. After starting the contract you can chat with the seller using the chat box on the right side of the page.

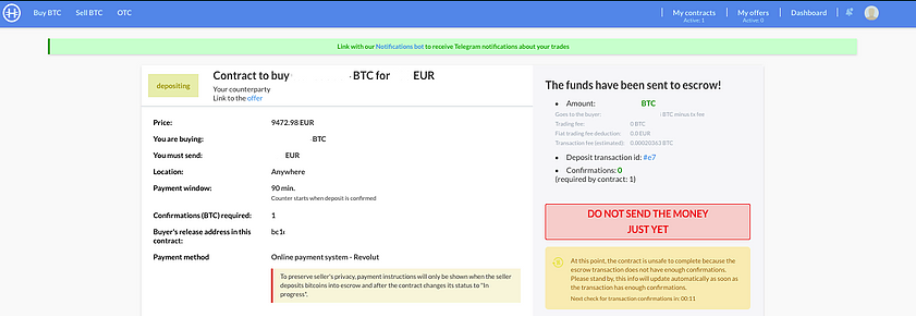

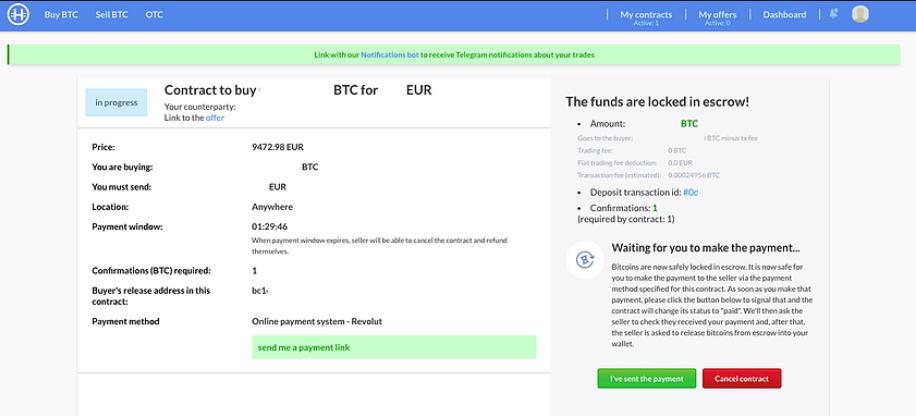

8. Once the seller has deposited their funds to the escrow you will see this screen advising you not to send your money until there has been sufficient number of blockchain confirmations (this varies depending on the trade conditions). You can check on the progress of the sellers deposit transaction by clicking on the blue link ‘Deposit Transaction ID’.

9. Once confirmed you will be notified and you can then send the funds to the seller to the details they will provide you. Once you have done this click ‘Ive Sent The Payment’.

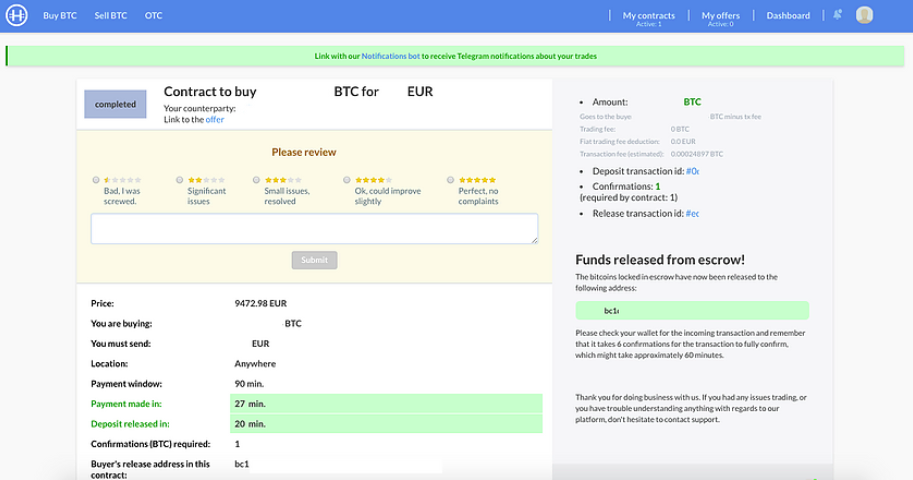

10. You will then need to wait for the seller to confirm they have received the funds, at which point the bitcoin will be released into the address you specified at the start of the contract. You will also be given the opportunity to rate your peer.

Congrats, you just bought yourself some non-KYC bitcoin!

Two final tips

- Hodl Hodl is web based so I would always advise accessing via the Tor browser to protect your privacy.

- If you are a Telegram user, make sure you link your profile with the Hodl Hodl bot. That way you will receive live updates on each trade allowing you to take quick action.

The tradeoffs with buying non-KYC

As simple as buying on Hodl Hodl is, there are some tradeoffs to be aware of.

1. KYC free bitcoin often attracts a premium above the spot price which can put some buyers off. As I discussed earlier, this is about tradeoffs and I would personally would be happy to pay 5-8% above spot price for the luxury of keeping my personal data safe.

If you are not in a rush to purchase then you can also set up a ‘Buy Offer’ where you can let the HodlHodl network know that you are willing to purchase an amount of bitcoin at a certain price relative to the market value. If a seller comes along and likes your offer they can take you up on it.

2. Decentralised exchanges can sometimes suffer from liquidity shortages when compared with larger centralised entities. If you are looking to buy larger amounts more frequently, you may struggle. Although, at Hodl Hodl you can fill out an OTC request and they will assist you in finding a counterparty.

3. Although it hasn’t happened to me, sometimes peer to peer trading doesn’t work out as intended and users will need to go through a dispute resolution process.

As with most things Bitcoin related, the whole KYC/no-KYC debate is nuanced and full of tradeoffs. I get it, the most common fiat onramps like Coinbase and CashApp make life very easy to buy, particularly for newbies, but please take a second to consider the tradeoffs and look into the alternatives before giving away your personal information so readily.

KYC is forever.

The next time you decide you want to stack some sats I urge you to give Hodl Hodl a try!

To read more about Hodl Hodl visit their FAQ page or watch this video.

Disclaimer - All views expressed in this article are my own and not those of the Hodl Hodl team. I am not affiliated with Hodl Hodl in any way.